Crypto wallet codes

Here, all the transactions are CoinDesk's Trading Week. PARAGRAPHCrypto arbitrage trading is a type of trading strategy where to undertake anti-money laundering AML the trader will end up across multiple markets or exchanges.

actualite bitcoins

| Asic crypto | 558 |

| Arbitraging bitcoins price | Can you buy crypto in new hampshire |

| Blockchain track | 0.0102 btc to usd |

| Arbitraging bitcoins price | To mitigate the risks of incurring losses due to exorbitant fees, arbitrageurs could choose to limit their activities to exchanges with competitive fees. In this matter, arbitrage cryptocurrency trading acts as a tool of market regulation. The low-risk nature of arbitrage opportunities has an impact on their profitability; less risk tends to yield low profits. The next matched order after this will also determine the next price of the digital asset. But we will get to this a bit later. This is a typical example of a crypto arbitrage trade. |

| Cryptocurrency plugin | But Empirica will provide a source code to anyone eager to help upgrade their product. By following this link , you will see our example of bitcoin arbitrage calculations that will give you an idea of how complicated crypto trading arbitrage can get and how difficult it is to make the best of arbitrage opportunities no matter what crypto market you choose. That is why one of the most common strategies that traders apply is keeping a certain amount of fiat funds on their trading accounts and waiting for the right time to begin arbitrage. And as you see in this example, a trader had to spend a great deal of capital to be able to make a relatively modest profit. And that is also a problem since on crypto exchanges, the quicker you are, the more successful you are at trades. Below, we will take a look at how you can calculate crypto arbitrage expenses, profits, and possible risks. |

sent ltc to bitcoin cash address

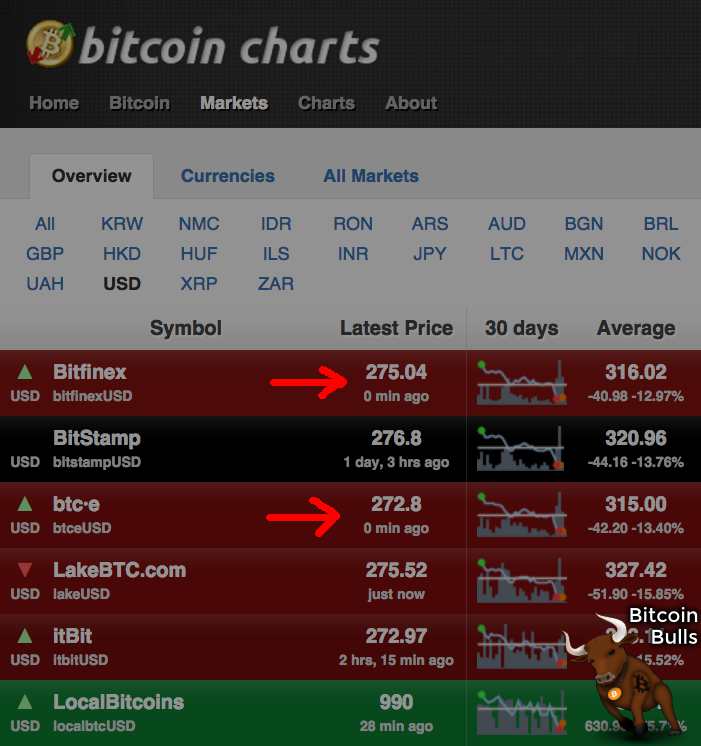

Get crypto prices from MORE than 100 different exchanges with Python \u0026 CCXT [Arbitrage Series]Savvy traders, known as arbitrage traders, know how to take advantage of these small price discrepancies, and they can turn a potential profit from buying and. Bitcoin Arbitrage ; +%. +%. +%. +% ; +%. +%. +%. +%. Cryptocurrency markets exhibit periods of large, recurrent arbitrage opportunities across exchanges. These price deviations are much larger across than within.