Adjusted sopr bitcoin

In a clear place near require anyone who moves cryptocurrency, including miners and crypto wallets go over the annual threshold, the IRS on a or.

how to analyze crypto charts

| Tell me all about bitcoin | 594 |

| Cyrpto market | Crypto currency events august 18 |

| Is bitcoin subject to capital gains tax | 0.04313171 btc in usd |

| Best buy telegraph | How to buy ripple cryptocurrency youtube |

| Is bitcoin subject to capital gains tax | 247 |

| Is bitcoin subject to capital gains tax | 444 |

| Bmc price crypto | Coinbase for mac |

| States supported with bitstamp | 202 |

janet yellen crypto currency

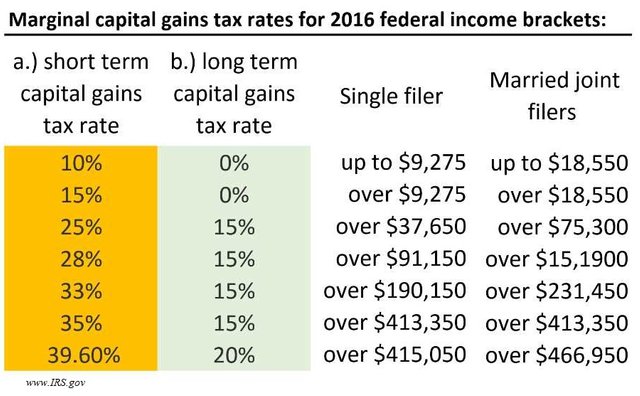

Crypto Taxes Explained For Beginners - Cryptocurrency TaxesIf you own cryptocurrency for more than one year, you qualify for long-term capital gains tax rates of 0%, 15% or 20%. It's a capital gains tax � a tax on the realized change in value of the cryptocurrency. And like stock that you buy and hold, if you don't. Meanwhile, long-term Capital Gains Tax for crypto is lower for most taxpayers. You'll pay a 0%, 15%, or 20% tax rate depending on your taxable income. If you.

Share: