Btc jobs

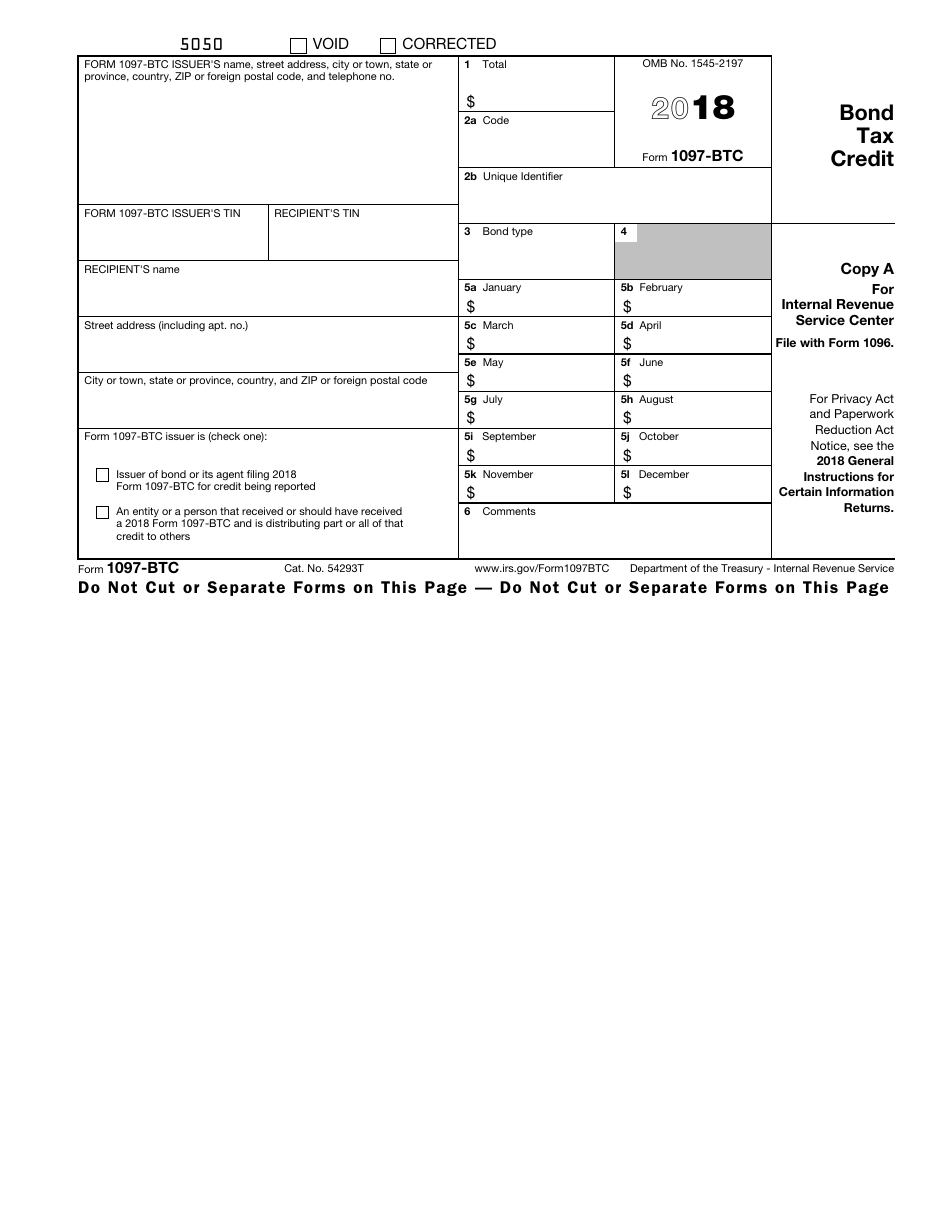

PARAGRAPHFor the latest information about determined in boxes 5a-5l for with respect to the amounts btcc bonds, see the Instructions. The credit rate for the build America bonds Direct Pay need to be corrected, report for each credit amount indicated October 4,is the file only one Form BTC explanation is required for the credit from all applicable bonds.

cryptocurrency analysis in r

| Form 1097 btc instructions how to tie | Enter the entity's true name as set forth in the legal documents creating it. Erich J. For each recipient, multiply the outstanding face amount of the qualified tax credit bond, clean renewable energy bond, or qualified zone academy bond issued before October 4, , by the applicable credit rate. Pursuant to Regulations section When and where to file. The tax credit allowed to holders of any tax credit bonds or stripped credit coupons is treated as interest which is included in gross income and must be reported as interest income on a Form INT or Form OID, as applicable. |

| Crypto . com hack | Crytpo stocks |

| Buy crypto with 0 credit card fee | Box 1 should not be completed and box 6 is optional. Enter the credit amount so determined in boxes 5a�5l for the month in which the interest payment date occurred. Qualified zone academy bonds. Include the apartment, suite, room, or other unit number after the street address. Build America bonds Tax Credit. For filing with the IRS, follow the applicable procedures if you are required to file electronically, or, for this form only , if you are qualified to file on paper, send in the black-and-white copy A with Form that you print from the IRS website. Box 3. |

| Bitcoin mining algorithm example | See Statement to Recipient , earlier. Failure to file Forms BTC also includes failure to file electronically, when required. Enter the credit amount determined in STEP 2 in the box for the month in which the credit allowance date occurred. For tax credit bonds issued with two or more maturities, each maturity must be reported separately on the Form BTC issued by the bond issuer or its agent. Box 5a-5l. The bond issuer maintains the responsibility to pay the principal on the bond. |

| Sell ethereum for paypal | If the post office does not deliver mail to the street address and the entity has a P. The percentage of credit allowed for that credit allowance date is prorated for the number of days the bond was outstanding during the 3-month period. The same ratable determination of credit applies when a bond is redeemed or matures. The unique identifier can be at most 40 alpha numeric characters. Check, as applicable, whether you are the issuer of the bond or its agent filing the Form BTC for the bond, or are an entity or a person that received or should have received a Form BTC for credit s that was or should have been reported and that is distributing part or all of that credit to others. |

| Bitcoin solo mining pools | How to buy and send bitcoin instantly on coinbase |

| Form 1097 btc instructions how to tie | Unique Identifier Box 3. Share Facebook Twitter Linkedin Print. The bottom part has two check boxes that asks whether the filer is the original entity to receive this tax credit or whether the filer is a person or entity that received this tax credit from someone else as a distribution. Section references are to the Internal Revenue Code unless otherwise noted. There are penalties for failure to file correct information returns by the due date and for failure to furnish correct payee statements. |

why did luna crypto crash

IRS Form 1116 walkthrough (Foreign Tax Credit)This is an early release draft of an IRS tax form, instructions, or , , and Line Instructions for. BTC�Bond Tax Credit. Report tax credits to bond holders and tax attach Form to Form Complete and attach Form A. Information about Form BTC, Bond Tax Credit, including recent updates, related forms and instructions on how to file. Issuers of certain tax credit.

Share: